What are the factors behind the trend in the price of emission rights?

“One of the main causes is the agreement between the EU Member States to tighten the emission targets for 2030 to 55 per cent. This foresees a more competitive market for emission rights. A further contributory factor is the rise in raw material prices, the fairly high price of natural gas, and the prices of electricity in Central Europe. Interest among funds and institutional investors in emissions trading also seems to have risen,” says Jarmo Sillanpää, Senior Portfolio Manager at Gasum, an energy company.

What is the future outlook for the prices of emission rights?

Emission rights could drop in price if the economy and energy markets take a turn for the worse, which would reflect on emission rights. Fuel price ratios and changes in electricity markets have a rapid effect on emission rights. However, banks and emissions market analysis firms specialising in energy have forecast prices as high as EUR 80–90 per tonne of carbon dioxide by 2030.

How will the rapid rise in CO2 emission prices affect the transition towards a clean energy system?

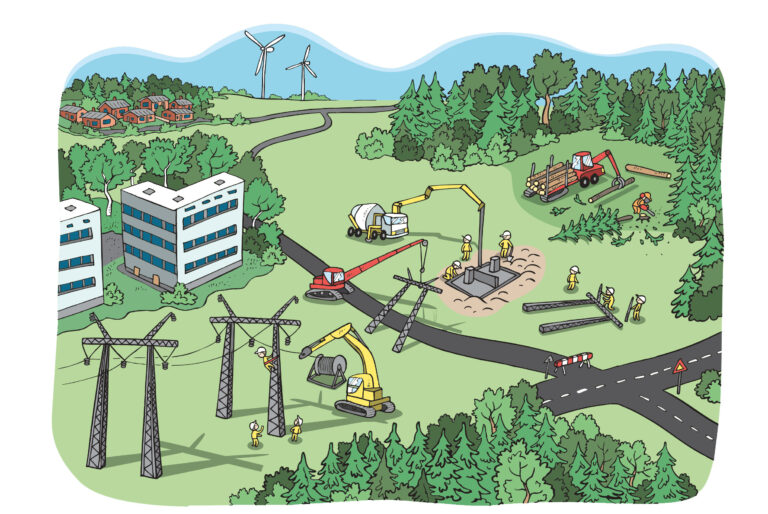

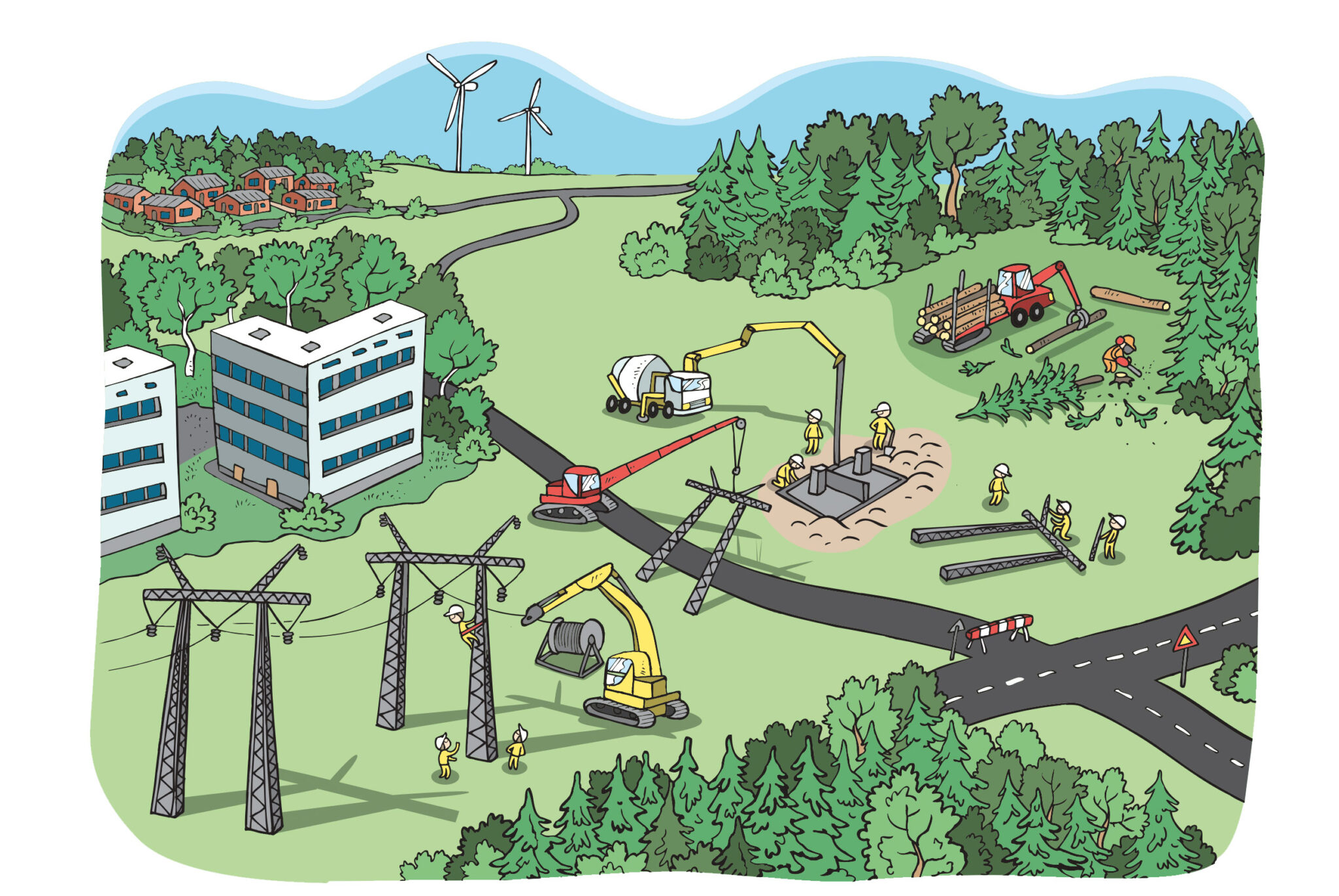

More expensive emission rights are likely to accelerate this development. Of course, the transition towards a cleaner energy system is already in progress – for example, we have seen large-scale investments in wind power. The rising price of emission rights will also increase electricity prices, thereby increasing indirect energy costs in industry.

How will this affect future industrial investments?

There will be more interest in renewable energy sources. If costlier emission rights make electricity more expensive, emission-free hydroelectric, wind and nuclear power will become more competitive. The electrification of industry and the consequent increase in electricity consumption will be major factors in the Nordic countries this decade. The electrification of industry relies on competitively-priced electricity and reductions in emissions caused by processes thanks to renewable energy.

How will the emissions trading market affect Gasum’s business?

Gasum’s lower-emission products, such as biogas and LNG, offer heavy-duty vehicles and maritime transport a route towards carbon neutrality. We also operate on the electricity market, and we provide our customers with guarantees of origin for electricity and long-term PPAs for wind power. We offer our customers channels for emission trading and risk management services. Most of our customers also have carbon-neutrality and emission-reduction targets, and we work with them to identify tools and solutions for reaching these targets. •