To balance the supply and demand of electricity and to ensure the delivery of agreed trades, versatile electricity market trading means that are needed. The cross-border power line fault in December 2022 is a prime example of that. Trading on the intraday markets has shown its practicability as a tool for enhancing operational security. The model trialed by Fingrid was made a permanent practice in November 2023.

When a cross-border interconnector is disrupted, Fingrid has several means to guarantee the previously made trades are delivered, as the interconnector is not capable of transmitting all the electricity traded on the electricity markets. In that case, Finland’s power balance of production and consumption can be remarkably amiss. Transmission system operators buy or sell electricity on both sides of the border, in order to limit the power flow to available transmission capacity. Also, new trading across the disrupted interconnector is limited until the disturbance ends.

One of the measures to manage cross-border interconnector disruptions is trading on the intraday markets. During Fingrid’s two-year trial of intraday counter trading (*, the operational model was tested in action in December 2022, when a northern cross-border interconnector broke down. By purchasing electricity from the intraday markets, the costs of the disturbance were reduced, the power balance was stabilized, and the adequacy of the balancing markets (mFRR) was enhanced in case of other disturbances.

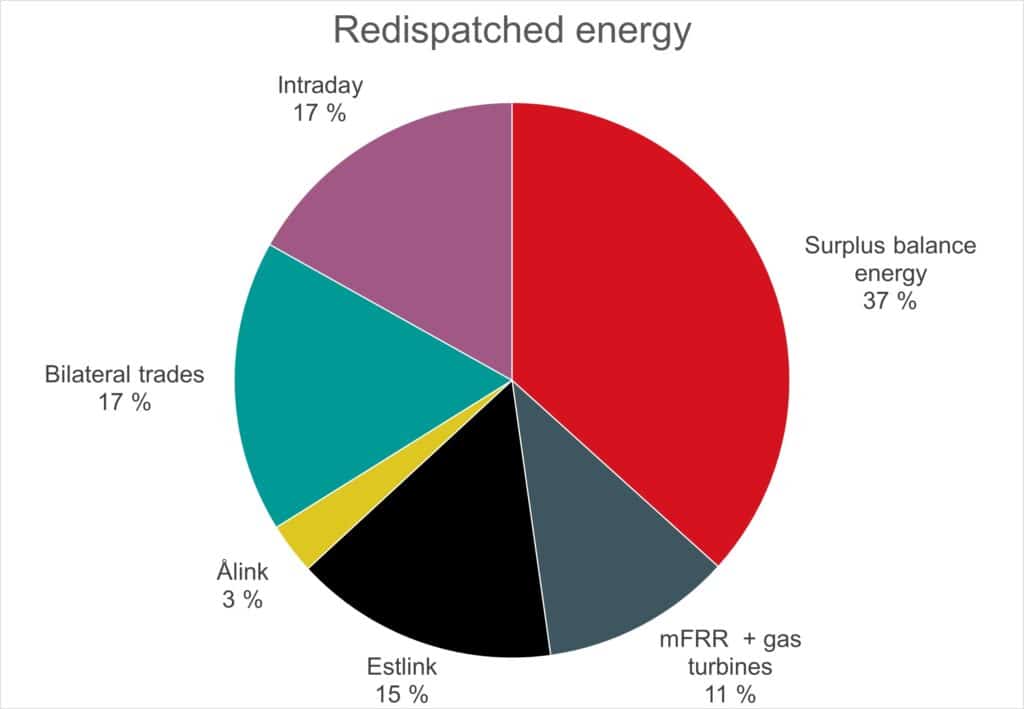

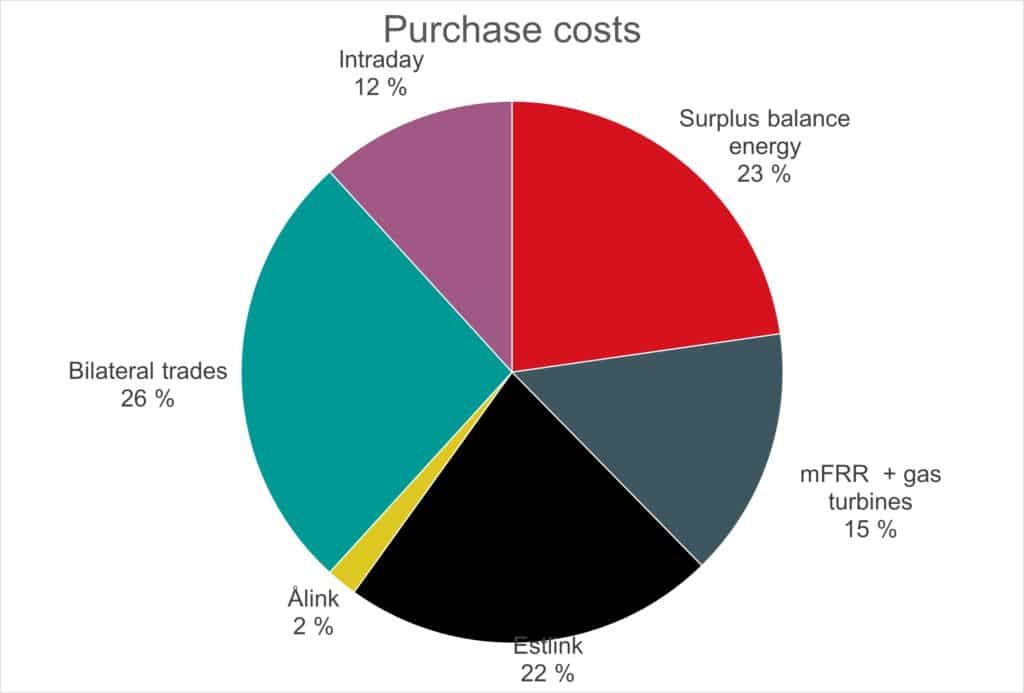

The interconnector fault in question is a prime example of the utilization of versatile congestion management measures. First, to restore the balance, reserve market participants reacted. Next, some of Fingrid’s emergency power plants were started and balancing market purchases began. After a couple of hours from the fault, Fingrid started buying electricity from the intraday markets a couple of hours before each hour. In addition, electricity was bought bilaterally from other transmission system operators and power plants, which secured adequacy of congestion management for a longer period.

A retroactive analysis shows that the electricity trades from the intraday markets were cheaper than purchasing a corresponding amount from the balancing energy market as special regulation. The 490 000 euros of costs saved could have been even more due to other restrictions of mFRR-bids (**. The cost savings of this use case cannot be generalized because several background factors affect the needed trading volumes, adequacy of the supply, and the price levels of different measures.

It is noteworthy that the balancing market bids, by themselves, would not have been adequate to fix all the imbalances caused by the cross-border fault during the down time. Also, the utilization of intraday trading and other measures released balancing market bids to be available for handling other possible disturbance events. Thus, intraday trading was significantly beneficial for the operational security of the Finnish electricity system.

Fingrid consulted electricity market actors publicly before the trial. No opposition for the trialed operational model was raised. During the trial, Fingrid shared experiences of the model with other Nordic transmission system operators. The model was made a permanent operational practice in November 2023.

Visa Simola

Planner

Fingrid Oyj

Terminology

*) Countertrades and congestion management

Countertrades are special commercial adjustments made to the transmission management of the electricity system. Special regulations resolve network bottlenecks that can limit the transmission of electricity within the Finnish grid or between it and the grids of neighboring countries. Countertrades change the regional distribution of electricity production or consumption on both sides of the network component that is limiting electricity transmission. Fingrid guarantees cross-border market transfers that it has already confirmed.

Commercial countertrades used to manage interruptions of cross-border transmission connections have been ordered from the balancing electricity market maintained by the transmission system operators in the form of special regulations or competitive bilateral transactions between Fingrid and market participants. The costs of countertrades are covered by grid tariffs and congestion income. The permanently established model refers to the application of intraday market trading to cross-border transfer management in addition to the countertrading models described above.

**) 490 000 € cost-savings are based on retroactive analyses of replacing the executed intraday market trades with special regulations from the mFRR market on top of the realized special regulation procurement. In reality, the executability of mFRR bids can be restricted by bottlenecks inside the price area of Finland, which could have led to a more expensive pool of available bids compared to the theoretical activation order used in the analysis.