In 2017, Fingrid continued systematic main grid development work for the electricity system of the future.

“Development of our total costs has remained under control for several years and we have now achieved a good balance between main grid pricing, operational costs and investments. That’s why we were able to keep tariffs at the same level in 2018,” says Chief Financial Officer Jan Montell.

Main grid transmission capacity is effectively used, and transmission reliability remained at an excellent level in 2017. The reliability of direct current connections, which are important for the electricity market, increased to the best level ever. Last year, a total of

66.2 TWh of electricity was transmitted in Fingrid’s grid, representing 75.5% of all electricity transmission in Finland.

A total of 15.6 TWh of electricity was imported from Sweden and 0.4 TWh was exported to Sweden. Electricity transmission between Finland and Estonia mainly consisted of exporting 1.7 TWh from Finland to Estonia. Electricity imports from Russia remained at the previous year’s level, and totalled 5.8 TWh.

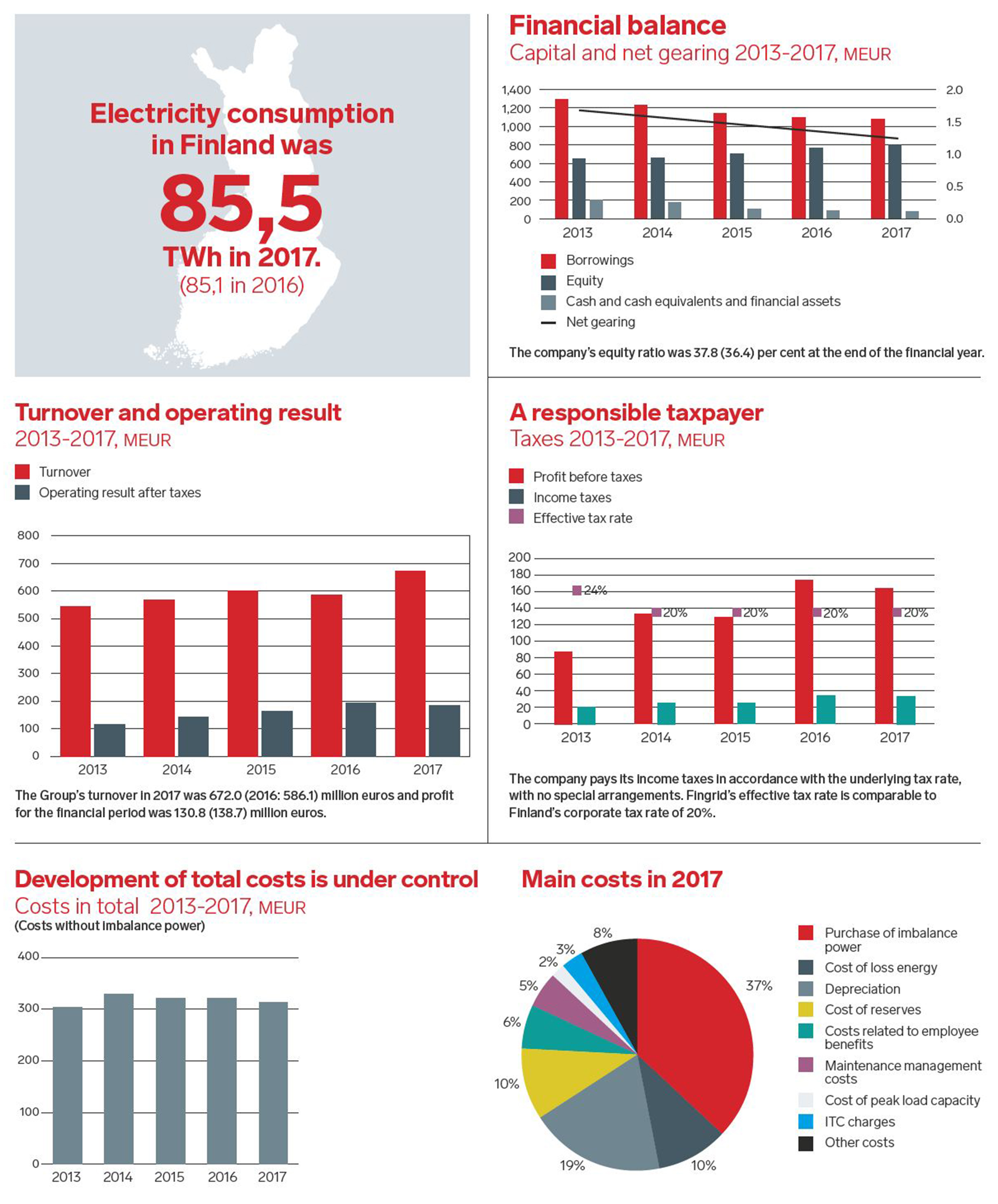

31 Million in taxes and 1 billion in debt

“Fingrid paid approximately 31 million euros in taxes in 2017. The company pays its taxes and dividends to Finland and, in terms of price level, it has been one of the most reasonably priced transmission system operators in Europe for a long time,” states Montell.

The company’s interest-bearing borrowings totalled 1,082.7 million euros, and 813.4 million euros of this was non-current borrowings. These figures are very close to last year’s level. The company’s liquidity remained good and it had a high credit rating.

In 2017, the company issued a 10-year Green Bond worth 100 million euros. The proceeds will be used to finance investments that are expected to have long-term, net positive environmental impacts. •

Read Fingrid’s entire annual report online: annualreport.fingrid.fi/en/