Unexpected disturbance situations in the electricity grid, such as exceptionally large and fast changes in the balance between electricity production and consumption, have traditionally been handled by increasing production. The terms used are frequency-controlled normal operation and disturbance reserves. The challenge associated with increasing power plant output and using reserve power plants is the delay: it takes several minutes for a reserve power plant of several dozen megawatts to become fully operational and during that time the electricity grid is unstable.

One possible solution is electricity demand response, which can respond to rapid fluctuations in production and consumption in just a few seconds.

Greenhouses to the rescue

Fingrid has acquired 456 megawatts of frequency-controlled disturbance reserve for 2017, approximately half of which comes from demand response and the other half from electricity production. This is double the demand response compared to last year. Fingrid pays 30 million euros for frequency-controlled reserves, and this also includes 55 megawatts of slower reserve, also known as frequency-controlled normal operation reserve.

“Adjustment of greenhouse lighting has become an important source of disturbance reserve,” says Fingrid’s Development Manager Jyrki Uusitalo.

The disturbance reserve means preparing for the worst, because unexpected exceptional situations only happen a few times per year.

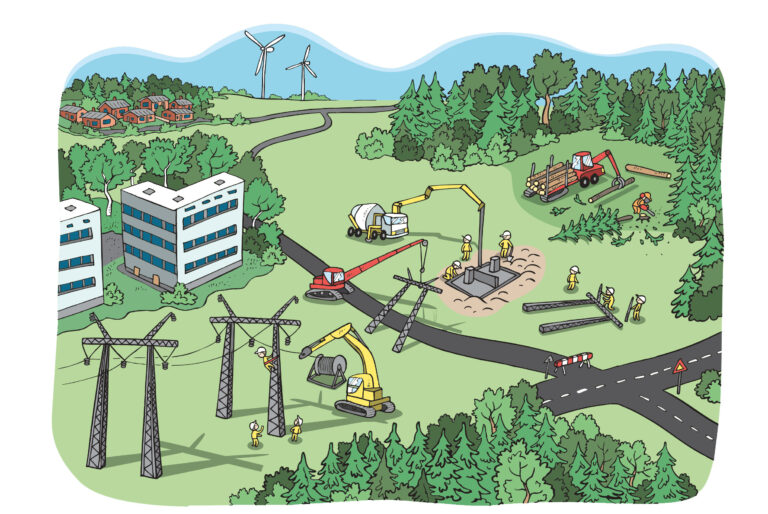

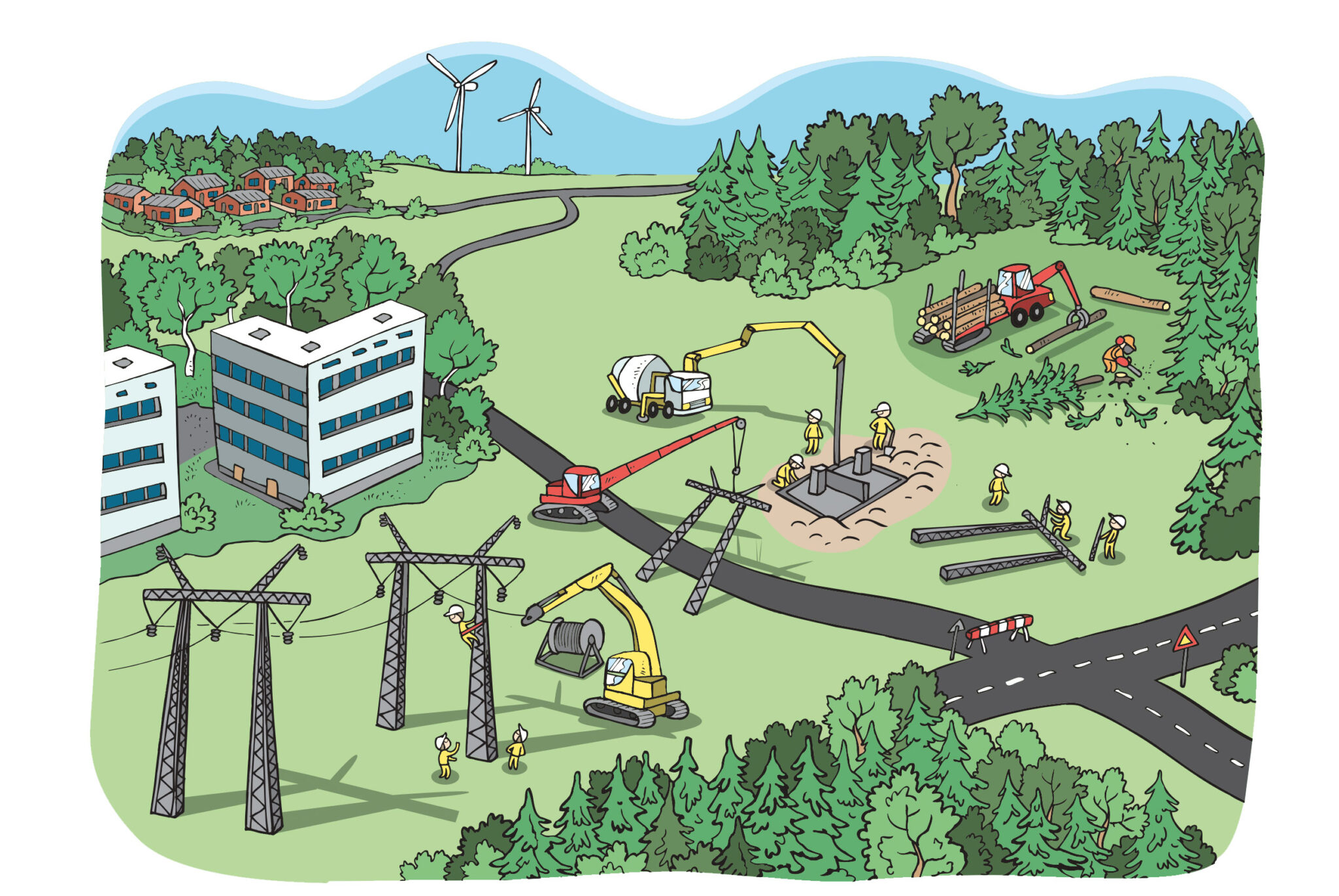

The new operating method changes the roles among electricity market actors. Aggregators have now joined electricity consumers and producers on the market. They link electricity producers and consumers in a new way. Aggregators combine small actors, such as greenhouses, into a single, larger entity. Dozens of greenhouses mean dozens of megawatts of flexibility. It is no longer possible to draw a clear line between suppliers and end users.

“This innovative operating method combines consumption and production sites in a smart manner, thus providing the market with more flexibility,” explains Uusitalo.

Fingrid maintains reserve markets, where it acquires disturbance reserves using annual contracts and also on a daily basis. This makes it possible to optimise the size of the disturbance reserve for every situation.

Part of a market change

The need for a new type of disturbance reserve is increasing as the structure of electricity production changes. Condensing power plants and the balancing power that they provide are being replaced by decentralised wind and solar power, which cannot be adjusted upwards. A disturbance reserve based on consumption is one solution to this change.

Utilising consumption is part of a major change in the electricity market, in which demand response is seen as a market force that can compete with traditional power plants.

“Consumption is rapidly becoming part of the balancing market. Specialised market aggregators, also known as demand operators, will become more important in the future. The EU Commission is trying to encourage a move in this direction,” says Uusitalo as he describes the market development.

In the future, smart electricity grid control can be utilised by, for example, using discharging electric car batteries when electricity is expensive and charging when electricity is cheap. Bilateral electricity market applications will also emerge in the form of selling the electricity produced in solar panels in homes to other consumers. Small-scale consumer wind power plants can also discharge electricity into the grid when it is not needed at the consumption site.