Although electricity market parties plan to balance their consumption and production in advance, it must be possible to balance deviations occurring during operations.

The measures taken to maintain the balance between production and consumption are called balancing management. The Nordic countries are currently in a phased transition to a new balancing model with new tools and methods.

Reform approaching the finish line

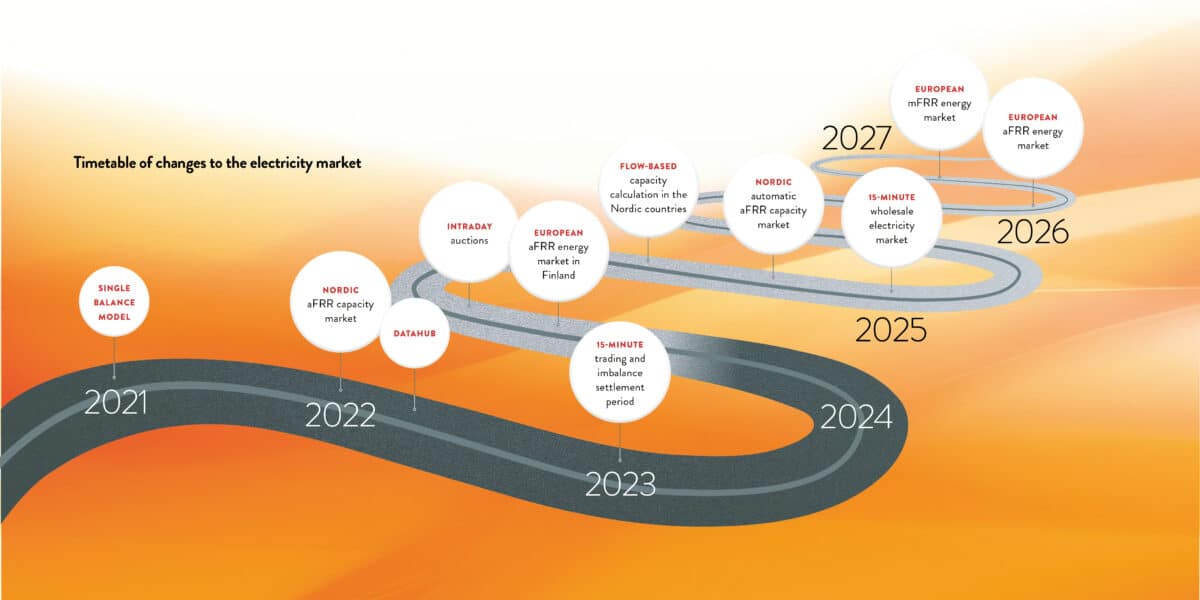

The single price model was introduced in 2021. Since then, the Nordic automatic Frequency Restoration Reserve (aFRR) capacity market was opened along with the Finnish manual Frequency Restoration Reserve (mFRR) capacity market.

Fingrid’s balancing management reform is now in the home straight.

“The ultimate goal of the balancing management reform is to secure the future functionality of the power system. Expanding the balancing markets will increase the reserves available to stabilise the power system quantitatively, regionally and geographically,” says Karri Mäkelä, Senior Expert at Fingrid.

He says the reform will enable Fingrid’s customers to participate more diversely in the electricity market.

“End users will see the increase in competition in their electricity bills.”

Power balance in 15-minute periods

The emerge of renewable energy generation has led to a decrease in conventional flexible production resources. Consequently, the one-hour power balancing period has become too long.

The transition to a 15-minute trading and imbalance settlement period will increase the precision of forecasts and plans and improve balancing management. The 15-minute period was introduced in Nordic balance management, energy metering and the Datahub in spring 2023.

The system will transition to imbalance pricing in 15-minute periods once the balancing power price is determined in 15-minute intervals and intraday cross-border trading in the Nordic countries switches to a 15-minute resolution.

Capacity market before the energy market

Fingrid maintains the Nordic balancing markets with the other Nordic transmission system operators. The capacity market should ensure adequate balancing capacity to maintain a power balance and operational reliability in the grid.

“Trading in the capacity market occurs by auction one day before the energy is delivered and before the rounds of trading on the power exchange,” Mäkelä says.

If an operator submits a bid to the capacity market and the bid is accepted, the operator undertakes to submit a corresponding bid to the energy market. The bidder can also trade in reserves directly in the energy market.

PICASSO and aFRR energy markets

PICASSO is the pan-European marketplace for aFRR energy. Fingrid is joining PICASSO in phases.

First, an aFRR energy market was established in Finland. In 2024, Fingrid will join PICASSO nationally, and the Nordic countries will join together in 2026.

Cross-border trading will become possible when either the Swedish or Estonian transmission system operator joins PICASSO.

Fingrid’s customers will not need to take any further action to establish PICASSO connections after the introduction of the Finnish aFRR energy market.

The mFRR capacity market expands

A national mFRR capacity market was introduced in Finland in autumn 2022. The mFFR capacity market will expand to a common market covering Sweden and Denmark in November 2024.

In practice, Fingrid will transfer its mFFR capacity market to a Nordic IT platform. Fingrid’s customers participating in the capacity market will also need to update their IT systems to operate on it.

“The expansion of the mFRR capacity market will increase the transmission of balancing power and capacity between countries and enhance competition,” Mäkelä says.

The Nordic mFRR energy market goes from one hour to 15 minutes

The joint mFRR energy market already in use in the Nordic countries will change when its market time unit switches from 60 minutes to 15 minutes in late 2024.

After the change, mFRR energy bids will be submitted, selected and activated in 15-minute periods.

The Nordic transition to the 15-minute market time unit will bring the connection to MARI, the European mFRR energy marketplace, one step closer. However, the change and process coordination still require major alterations to the market process and information systems.

The transition to a 15-minute market time unit in the mFRR energy market will improve the forecasting of consumption and production and the cost-effectiveness of power balancing in the grid.

A 15-minute wholesale electricity market

The day-ahead and intraday markets are gradually transitioning to a 15-minute resolution. In Finland, trading in 15-minute local products on the intraday market began in spring 2023.

Intraday cross-border trading on the Nordic countries will be possible on 15-minute resolution in early 2025 after the mFRR energy market goes live.

“The change enables balancing close to the moment of consumption”,” says Marja Eronen, Senior Expert at Fingrid.

“The 15-minute market time unit will be introduced in the day-ahead market throughout Europe in early 2025. After that, all market parties trading on the electricity exchange will be able to submit bids accurate to 15 or 60 minutes.”

However, spot prices will be calculated and published in a 15-minute resolution.